Buying a home is one of the most exciting moments in life. But imagine this: you finally purchase your dream house, only to find out later there are ownership issues because you misunderstood the deed. This legal paper is not just any document; it’s the key to proving you truly own your property. If you’ve ever asked yourself, “how deed of real estate house works,” you’re in the right place.

What is a House Deed?

A house deed is the official paper that proves who owns a piece of real estate. Think of it as the ultimate proof that the house you live in or want to buy legally belongs to you. This document usually includes very specific details about the property and the people involved in the sale.

Key Components of a House Deed

To really grasp what a deed contains, here are the essential parts you’ll find on almost every deed:

- Parties Involved: Names of the seller (called the grantor) and the buyer (called the grantee).

- Legal Property Description: This isn’t just an address. It includes boundary lines, size, and a detailed description that legally defines the property.

- Transfer Terms and Conditions: This explains how the ownership is being transferred, including any promises or conditions.

- Date and Signatures: Both parties sign the deed, and often a notary public seals it to make it official.

Types of Real Estate Deeds

Not all deeds are created equal. Different types of deeds offer varying levels of protection and guarantees to the buyer. Let’s explore the most common types and when you might encounter them.

Deed Type Description Protection Level Best For

Warranty Deed Guarantees clear title with no hidden liens Highest Most home sales

Quitclaim Deed Transfers interest without any guarantees None Family transfers, divorces

Grant Deed Warrant no defects after transfer Medium Common in California

Special Warranty Only covers issues during the seller’s ownership Limited Commercial property deals

Deed of Trust Includes trustee for loan security Loan-specific Mortgaged properties

When to Use Each Deed Type

- Warranty Deed: If you’re buying a house from a stranger, this is the gold standard. It protects you from future claims or debts tied to the property.

- Quitclaim Deed: Used mostly between family members or in situations like divorce. It transfers whatever interest the seller has, but it doesn’t make any promises.

- Grant Deed: Common in some states, such as California, it offers moderate protection, ensuring the seller hasn’t concealed any defects.

- Special Warranty Deed: Often used in commercial real estate, it only promises the property was free of issues during the seller’s ownership.

- Deed of Trust: This is related to loans. It involves a third party holding the deed until the buyer pays off their mortgage.

By understanding these types, you’ll know what to expect and what kind of protection your deed offers when buying a home.

How to Read a House Deed

Reading a deed might seem complicated at first, but breaking it down makes it much easier. Here’s a simple step-by-step guide to help you understand the key sections of your house deed.

Identify the Parties

Look for the grantor (seller) and grantee (buyer) names. Check for correct spellings and full legal names. Mistakes here can cause serious trouble later.

Locate the Property Description

This section describes the exact boundaries and the property’s size. It might use something called metes and bounds—a method that describes the property based on physical features and measurements.

Check Consideration and Exceptions

The deed will state the sale price or consideration. Sometimes it also mentions exceptions, such as liens (debts against the property) or easements (rights others have to use the land).

Verify Signatures and Dates

Ensure both parties signed the deed and that it has a date. Also, look for a notary public’s seal, which makes the document legally binding.

Common Pitfalls

- Misspelled names

- Vague or incomplete property descriptions

- Missing signatures or notarization

Being aware of these can save you headaches. If you have a copy of your deed, follow this guide step by step.

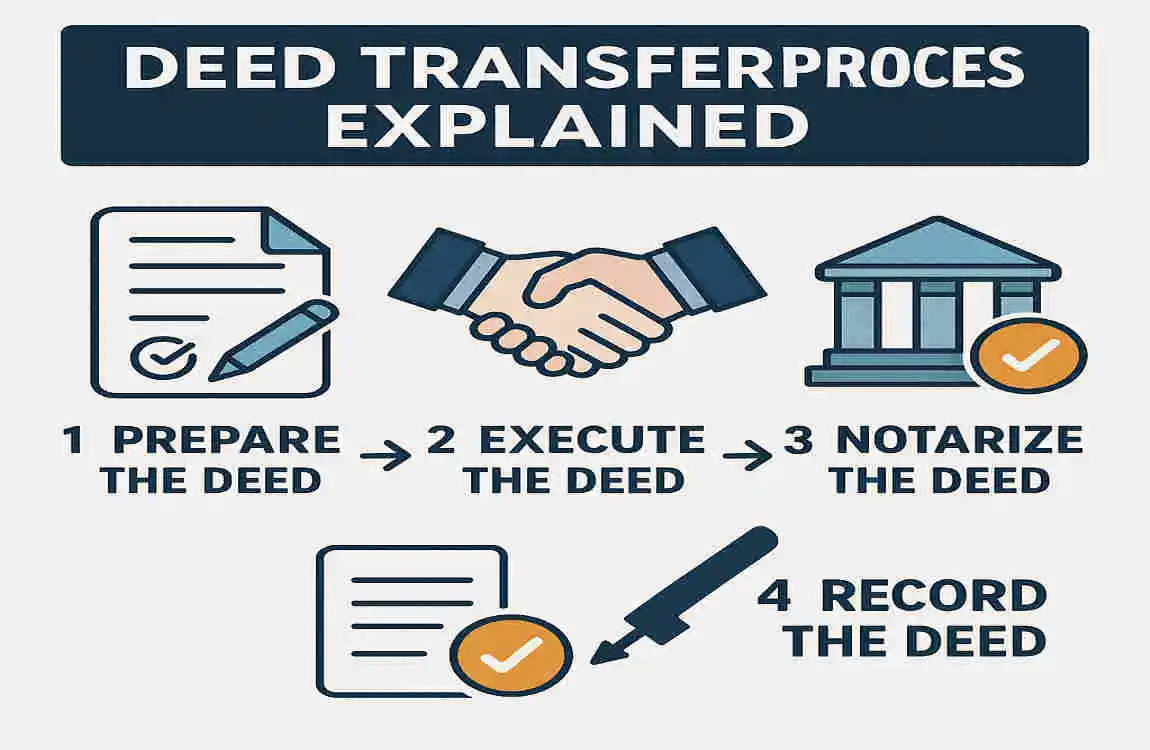

Deed Transfer Process Explained

Now that you know what a deed is and how to read it, let’s walk through the process of transferring a deed when buying or selling a house.

Prepare the Deed After Sale Agreement

Once buyer and seller agree on the sale, the deed is prepared. This document will include all the key information discussed earlier.

Signing and Notarization

The seller signs the deed in front of a notary public, who verifies identities and witnesses the signing. This step is crucial for the deed to be valid.

Delivering the Deed to Buyer

At closing—the final step of the sale—the seller hands over the signed deed to the buyer, officially transferring ownership.

Recording at County Recorder’s Office

This is one of the most important steps. The buyer or their representative must file (record) the deed at the local county recorder’s office. Recording the deed:

- Makes the ownership public record

- Protects you from fraud or claims by others

- Helps establish clear property history

Paying Fees

You’ll usually pay a recording fee and possibly transfer taxes at this stage. These costs vary by location.

Location Variations

The process above is typical in the United States. In other countries, such as India, additional steps or documents may be required, including stamp duty payments or special registration procedures.

Common Mistakes and How to Avoid Them

When dealing with house deeds, mistakes can be costly. Here are some common errors and simple fixes to keep your ownership safe.

Mistakes to Watch For

- Name Spelling Errors: Always double-check legal names against government IDs.

- Incomplete Property Descriptions: Use a professional survey to avoid vague boundaries.

- Skipping Recording: Not recording the deed means your ownership might not be legally recognized.

- Ignoring Liens: Always perform a title search to uncover unpaid debts.

- DIY Without Notary: Never sign or transfer a deed without notarization; it may be invalid.

How to Avoid These Problems

- Consult a real estate attorney or title company.

- Use professional services for surveys and title searches.

- Always follow local rules for deed recording and notarization.

Taking these precautions protects your investment and your peace of mind.

Importance of Recording Your Deed

Recording your deed is not just a bureaucratic step; it’s vital for securing your property rights.

- Public Notice: It officially alerts everyone that you own the property.

- Fraud Protection: Prevents others from falsely claiming your property.

- Title Insurance: Required for obtaining insurance that protects your ownership.

- Legal Compliance: Most states and countries require recording to validate the transaction.