Imagine this: you’re enjoying a quiet evening at home when you notice a damp spot on your floor. You investigate further and realize it’s coming from a plumbing leak under your slab foundation. Suddenly, your peaceful night turns stressful. As a homeowner, you’re likely wondering, “Does homeowners’ insurance cover plumbing leaks under the slab?”

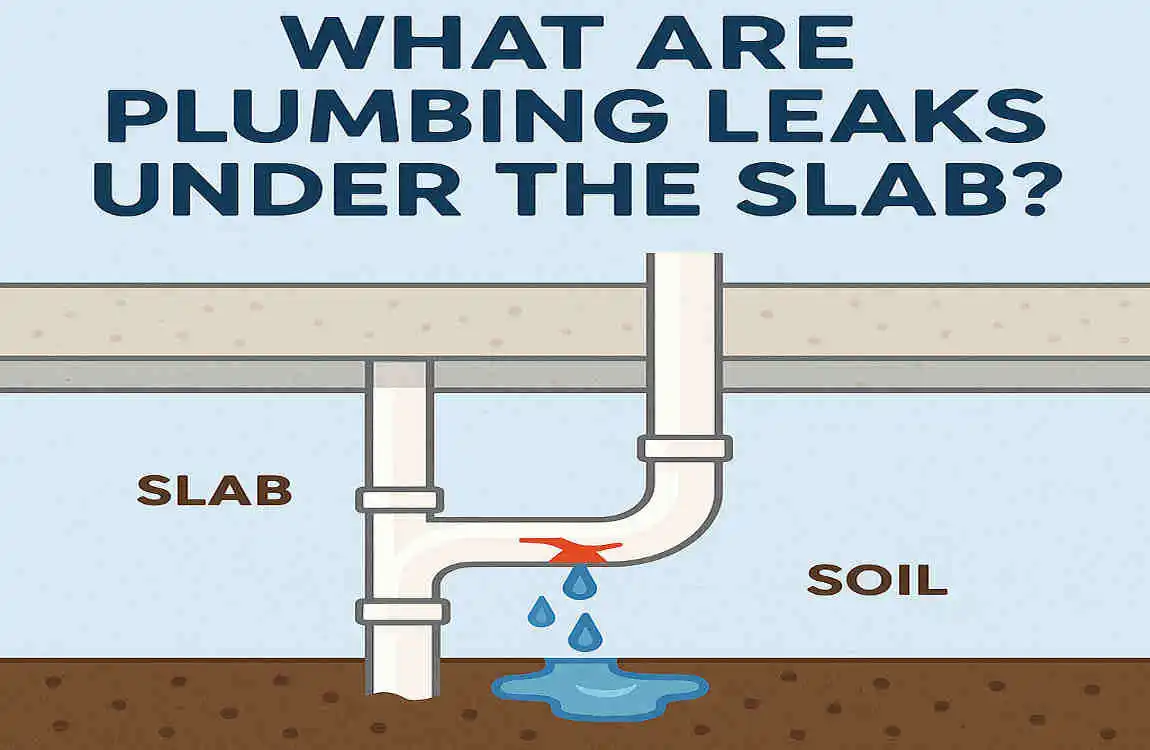

What Are Plumbing Leaks Under the Slab?

Understanding Slab Foundations and Plumbing Systems

Before we can discuss insurance coverage, let’s take a moment to understand what we’re dealing with. Many homes, especially in warmer climates, are built on slab foundations. This means that the plumbing pipes are often located beneath the concrete slab.

Common Causes of Under-Slab Leaks

So, what causes these pesky leaks? There are several common culprits:

- Corrosion: Over time, pipes can corrode, especially if they’re made of older materials like galvanized steel.

- Shifting Soil: The soil beneath your home can shift, putting pressure on pipes and causing them to crack or break.

- Poor Installation: If the plumbing wasn’t installed correctly in the first place, it may be more prone to leaks.

- Tree Roots: In some cases, tree roots can grow into the pipes, causing damage and leaks.

Signs and Symptoms of Slab Leaks

How can you tell if you leak your slab? Keep an eye out for these signs:

- Water Damage: You may notice water stains, dampness, or even pooling water on your floors.

- Mold and Mildew: Leaks can create the perfect environment for mold and mildew to grow.

- Uneven Floors: In severe cases, a slab leak can cause your floors to become uneven or buckle.

- Higher Water Bills: If you notice a sudden increase in your water bill, it could be due to a hidden leak.

The Cost and Disruption of Slab Leaks

Dealing with a slab leak is not only frustrating but also expensive. Repairing the leak itself can be costly, and if the water has caused damage to your home’s structure or belongings, the bill can quickly add up. Plus, repairing a slab leak often involves tearing up floors and digging into the concrete, which can be disruptive to your daily life.

Basics of Homeowners Insurance: What It Typically Covers

Structure of a Standard Homeowners Insurance Policy

Now that we’ve covered the basics of slab leaks, let’s talk about homeowners’ insurance. A typical policy is divided into several key components:

- Dwelling Coverage: This protects the structure of your home, including the walls, roof, and foundation.

- Personal Property Coverage: This covers your belongings, such as furniture, clothing, and electronics.

- Liability Coverage: This protects you if someone is injured on your property and sues you.

- Additional Living Expenses: If your home becomes uninhabitable due to a covered event, this coverage can help pay for temporary housing and other expenses.

What “Sudden and Accidental” Damage Means for Plumbing

When it comes to plumbing leaks, the key phrase to look for in your policy is “sudden and accidental.” This typically means that if a pipe suddenly bursts or a leak occurs unexpectedly, it may be covered by your insurance. However, if the leak is due to gradual wear and tear or poor maintenance, it may not be covered.

Limitations and Exclusions in Policies

It’s important to note that homeowners’ insurance policies often have limitations and exclusions regarding plumbing and water damage. For example:

- Flood Damage: Most standard policies do not cover damage caused by flooding, which is typically defined as water entering your home from outside.

- Sewer Backup: Damage caused by a sewer backup is usually not covered unless you have a specific endorsement or rider on your policy.

- Neglect or Lack of Maintenance: If a leak is caused by your failure to maintain your plumbing system properly, it may not be covered.

Does Homeowners Insurance Cover Plumbing Leaks Under Slab? — The Reality

Coverage Specifics for Slab Leaks

Now, let’s get to the heart of the matter: does homeowners’ insurance cover plumbing leaks under the slab? The answer is, it depends. Here’s what you need to know:

Situations Where Coverage Usually Applies

In general, if a plumbing leak under your slab is sudden and accidental, it may be covered by your homeowners’ insurance. This could include:

- Pipe Bursts: If a pipe suddenly bursts due to a manufacturing defect or extreme temperature changes, it’s likely to be covered.

- Accidental Leaks: If a leak occurs due to an unexpected event, such as a tree root breaking into the pipe, it may also be covered.

Typical Exclusions for Slab Leaks

However, there are several situations where a slab leak may not be covered:

- Slow Leaks: If the leak develops gradually over time, it may be considered a maintenance issue and not covered.

- Poor Maintenance: If the leak is caused by your failure to maintain your plumbing system properly, it’s unlikely to be covered.

- Gradual Damage: If the leak causes gradual damage to your home over time, such as mold growth or structural damage, it may not be covered.

The Impact of “Wear and Tear” and “Maintenance Issues”

One of the most significant factors in determining whether a slab leak is covered is whether it’s considered to be caused by “wear and tear” or “maintenance issues.” If your insurance company determines that the leak could have been prevented with proper maintenance, they may deny your claim.

Common Misconceptions About Coverage

Myth: All Plumbing Leaks Are Covered

One of the biggest misconceptions about homeowners’ insurance is that all plumbing leaks are covered. As we’ve discussed, this is not the case. The specifics of your policy, as well as the cause of the leak, will determine whether it’s covered.

Myth: Water Damage from Leaks Is Always Reimbursed

Another common myth is that your insurance company will reimburse any water damage caused by a leak. However, this is not always true. If your policy does not cover the leak, the resulting water damage may also not be covered.

Myth: Homeowners Insurance Covers Repair of the Slab Itself

Some homeowners mistakenly believe that their insurance policy will cover the cost of repairing the slab itself if a leak damages it. In most cases, this is not true. Your policy may cover the cost of repairing the leak and any resulting water damage, but not the actual slab repair.

Water Damage Repairs vs. Plumbing System Repairs

It’s essential to understand the difference between water damage repairs and plumbing system repairs when it comes to insurance coverage. Water damage repairs typically involve fixing any damage caused by the leak, such as replacing flooring or drywall. Plumbing system repairs, on the other hand, include fixing the actual leak itself. Your policy may cover one or both of these types of repairs, depending on the specifics of your coverage.

What Homeowners Should Check in Their Policy Regarding Slab Leak Coverage

How to Read and Interpret Policy Language

When it comes to understanding your homeowners’ insurance policy, the devil is in the details. Here are some key things to look for:

- Water Damage Coverage: Check whether your policy explicitly covers water damage from plumbing leaks.

- Sudden and Accidental Damage: Look for language that covers “sudden and accidental” damage to your plumbing system.

- Exclusions and Limitations: Pay attention to any exclusions or limitations related to plumbing leaks, such as those caused by wear and tear or poor maintenance.

Questions to Ask Your Insurance Provider

If you’re unsure about your coverage for slab leaks, don’t hesitate to reach out to your insurance provider. Here are some questions you should ask:

- Is my policy likely to cover a slab leak?

- What specific situations would be covered or not covered?

- Are there any endorsements or riders I can add to my policy for additional coverage?

- What is the claims process for a slab leak, and what documentation will I need to provide?

The Importance of Endorsements and Riders

If you’re concerned about the potential for a slab leak, consider adding an endorsement or rider to your policy for additional coverage. These can provide extra protection in specific situations, such as sewer backups or water damage from leaks. Talk to your insurance agent about your options and the cost of adding these additional coverages.

How to Handle an Under-Slab Plumbing Leak Claim

Step-by-Step Guide to Filing a Claim

If you do experience a slab leak and need to file a claim with your insurance company, follow these steps:

- Document the Damage: Take photos and videos of the leak and any resulting water damage. Keep a record of any expenses you incur, such as hotel stays or meals, if you need to relocate temporarily.

- Contact Your Insurance Company: Notify your insurance company as soon as possible to start the claims process. They’ll likely send out an adjuster to assess the damage.

- Hire a Professional: It’s a good idea to hire a professional plumber or leak detection specialist to evaluate the situation and provide a repair estimate. This can help support your claim.

- Submit Your Claim: Provide your insurance company with all the necessary documentation, including photos, repair estimates, and any other relevant information.

- Work with Your Adjuster: Your insurance adjuster will work with you to determine the extent of the damage and the amount of your claim. Be sure to communicate clearly and provide any additional information they request.

Documentation Required for Claims

When filing a claim for a slab leak, be sure to have the following documentation ready:

- Photos and Videos: Visual evidence of the leak and any resulting water damage.

- Repair Estimates: Quotes from professional plumbers or contractors for the cost of repairing the leak and any damage.

- Receipts and Invoices: Keep records of any expenses you incur as a result of the leak, such as temporary housing or meals.

- Inspection Reports: If you’ve had a professional inspection or leak detection, include the report with your claim.

The Importance of Professional Leak Detection and Assessment

When dealing with a slab leak, it’s crucial to have a professional assess the situation. A plumber or leak detection specialist can help you determine the cause and extent of the leak and provide a repair estimate. This information can be invaluable when filing a claim with your insurance company.

Tips to Avoid Claim Denials

To increase your chances of a successful claim, keep these tips in mind:

- Act Quickly: Notify your insurance company as soon as possible after discovering the leak.

- Document Everything: Take photos, videos, and keep records of all expenses related to the leak.

- Hire Professionals: Use licensed plumbers and contractors to assess and repair the damage.

- Be Honest: Provide accurate and complete information to your insurance company. Don’t try to hide any pre-existing issues or neglect.

Alternatives and Supplementary Coverage Options for Slab Leaks

Additional Coverage Options to Consider

If you’re concerned about the potential for a slab leak, there are several additional coverage options you may want to consider:

- Water Backup and Sump Overflow Coverage: This can protect against damage from sewer backups or sump pump failures.

- Home Warranty Plans: Some home warranty plans cover plumbing repairs, which can help offset the cost of slab-leak repairs.

- Separate Slab Leak Insurance or Endorsements: Some insurance companies offer specific coverage for slab leaks, either as a standalone policy or as an endorsement to your existing homeowners’ insurance.

Weighing the Cost vs. Benefit of Extra Coverage

When considering additional coverage options, it’s essential to weigh the cost against the potential benefit. While these coverages can provide peace of mind and financial protection, they may also increase your insurance premiums. Talk to your insurance agent about your options and the costs involved to make an informed decision.

Preventive Measures to Avoid Expensive Slab Leaks

Routine Plumbing Inspections and Maintenance

One of the best ways to avoid a costly slab leak is to stay on top of routine plumbing inspections and maintenance. Here are some tips:

- Schedule Annual Inspections: Have a licensed plumber inspect your plumbing system at least once a year to catch any potential issues early.

- Check for Leaks: Regularly check under sinks, around toilets, and in other areas where leaks are common.

- Flush Your Water Heater: Flushing your water heater annually can help prevent sediment buildup and corrosion.

- Insulate Pipes: Insulating your pipes can help prevent them from freezing and bursting in cold weather.

Signs to Monitor for Early Leak Detection

By keeping an eye out for these signs, you may be able to catch a slab leak early and minimize the damage:

- Water Stains: Keep an eye out for water stains on walls, ceilings, or floors.

- Mold and Mildew: If you notice mold or mildew growth, it may indicate a hidden leak.

- Higher Water Bills: A sudden increase in your water bill could indicate a hidden leak.

- Strange Noises: If you hear gurgling or running water sounds when no fixtures are in use, it could be a sign of a leak.

The Impact of Soil Conditions and Landscaping

The soil conditions and landscaping around your home can also affect the likelihood of a slab leak. Here’s what you need to know:

- Expansive Soil: If your home is built on expansive soil that expands and contracts with moisture changes, it can put pressure on plumbing pipes, increasing the risk of leaks.

- Tree Roots: If you have trees near your home, their roots can grow into your plumbing pipes, causing damage.

- Proper Grading: Ensuring that the ground around your home is graded correctly can help prevent water from pooling near your foundation and increase the risk of leaks.

Benefits of Installing Leak Detectors or Monitoring Systems

Installing leak detectors or monitoring systems in your home can provide an extra layer of protection against slab leaks. These devices can alert you to the presence of water, even if it’s hidden beneath your slab. Some systems can even automatically shut off your water supply in the event of a leak, helping to minimize damage.

Real-Life Examples and Case Studies

Successful Claims for Slab Leaks

Let’s take a look at a few anonymized examples of homeowners who successfully claimed insurance for slab leaks:

- Case Study 1: A homeowner in Florida noticed a damp spot on their floor and called a plumber, who discovered a slab leak caused by a tree root. The homeowner’s insurance policy covered the cost of repairing the leak and the resulting water damage.

- Case Study 2: A couple in California experienced a sudden pipe burst under their slab, causing significant water damage to their home. Their insurance company covered the cost of repairs, as the leak was deemed sudden and accidental.

Denied Claims and Lessons Learned

Unfortunately, not all slab leak claims are successful. Here are a couple of examples of denied claims and the lessons learned:

- Case Study 3: A homeowner in Texas filed a claim for a slab leak, but their insurance company denied it, citing poor maintenance as the cause. The lesson here is to stay on top of routine plumbing maintenance to avoid claim denials.

- Case Study 4: A family in Arizona had their claim denied because the leak was deemed to be gradual and caused by wear and tear. This highlights the importance of understanding your policy’s exclusions and limitations.

The Impact of Insurance Coverage on Repairs and Costs

The presence or absence of insurance coverage can significantly impact the cost and process of repairing a slab leak. If your claim is approved, your insurance company will typically cover the cost of repairing the leak and any resulting water damage, up to your policy limits. However, if your claim is denied, you’ll be responsible for the full cost of repairs out of pocket.