Real estate taxes and property taxes are related but not precisely the same. Real estate taxes specifically refer to taxes levied on real property, such as land and any structures on it, like a house. Property taxes, on the other hand, are a broader term that can apply to both real estate and different types of personal property, such as cars or boats. While the terms are often used interchangeably, technically, real estate taxes are a subset of property taxes focused only on immovable property. In contrast, property taxes can include movable personal items as well.

Understanding Real Estate Taxes and Property Taxes

Real estate taxes and property taxes are often used interchangeably, but they serve different purposes. Real estate taxes specifically pertain to the value of land and buildings. Local governments assess them to fund essential services like schools, roads, and emergency services.

Property taxes encompass a broader category that includes both real estate and personal property, such as vehicles or equipment. However, for most homeowners, the focus is primarily on real estate taxes tied directly to their homes.

Understanding both types of taxation can help homeowners navigate expenses more efficiently. It’s essential to recognize how these assessments impact your overall financial landscape and what obligations come with owning residential properties. Clarity around these terms allows you to better prepare for upcoming payments when tax season rolls around.

What is the Difference Between Real Estate Taxes and Property Taxes?

Real estate taxes and property taxes often seem interchangeable, but subtle distinctions exist. Real estate taxes specifically pertain to land and structures affixed to it. These are levied based on the assessed value of your home and other buildings.

Property taxes, on the other hand, cover a broader scope. They can include real estate as well as personal property, like vehicles or boats, in certain jurisdictions.

The key difference lies in their application. While all real estate tax is a type of property tax, not all property tax falls under the umbrella of real estate taxes.

Understanding this difference matters when budgeting for homeownership costs or appealing assessments with your local taxing authority. Each type has its own set of regulations and implications that can affect your financial planning significantly.

How are Real Estate and Property Taxes Calculated?

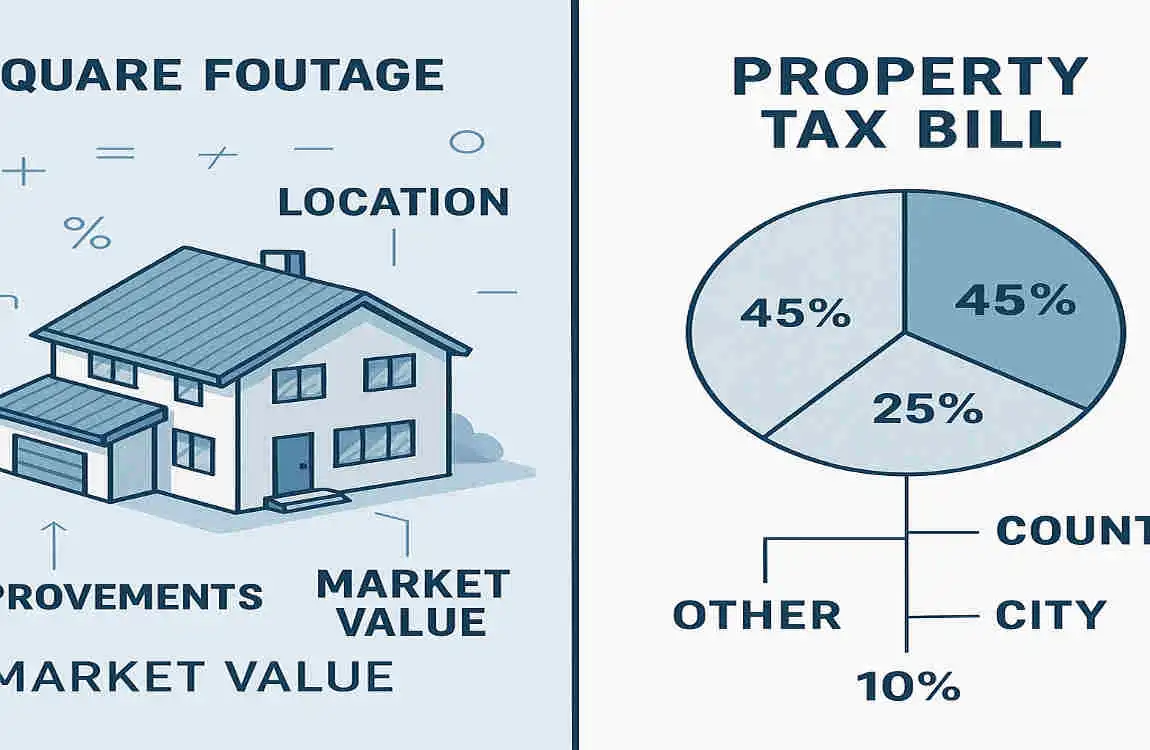

Calculating real estate and property taxes can seem daunting, but it follows a straightforward process. Local government authorities assess the value of your property, which is often based on recent sales of similar homes in your area.

Once the assessed value is determined, tax rates are applied to this figure. These rates vary by location and are influenced by the budgets needed for public services such as schools, roads, and emergency services.

Homeowners might also encounter exemptions or deductions that can lower their taxable amount. For example, senior citizen discounts or homestead exemptions may apply depending on local laws.

It’s essential to stay informed about your property’s assessment details, as discrepancies can lead to overpayment. Regularly reviewing these factors ensures you’re not paying more than necessary each year.

Factors that Affect Real Estate and Property Tax Rates

Various factors play a role in determining real estate and property tax rates. One significant element is the location of the property. Urban areas often have higher taxes due to increased demand for services and infrastructure.

The assessed value of the property also impacts tax rates. This value can fluctuate based on market conditions, renovations, or neighborhood developments. A spike in local home prices may lead to an increase in assessments, raising your tax bill.

Local government budgets are another key factor. If municipalities require more funding for schools, roads, or emergency services, they might raise tax rates accordingly.

Understanding these variables helps homeowners anticipate changes in their tax bills over time. Staying informed allows better financial planning when it comes to real estate investments.

Ways to Reduce Your Real Estate and Property Tax Bill

Reducing your real estate and property tax bill requires a proactive approach. Start by reviewing your property assessment. If you believe it’s inaccurate, file an appeal with your local tax assessor’s office.

Explore exemptions that may apply to you. Many jurisdictions offer programs for seniors, veterans, or low-income households. These can significantly reduce your taxable value.

Consider making strategic improvements to your home. Energy-efficient upgrades often qualify for additional deductions or credits, easing the overall financial burden.

Don’t overlook the power of organization. Keep detailed records of all expenses related to homeownership; this documentation can be beneficial during assessments or appeals.

You may also read (are you a home lessor key tips for residential house rentals).

Common Misconceptions about Real Estate and Property Taxes

Many homeowners believe that real estate taxes and property taxes are interchangeable terms. In reality, while they often overlap, nuances exist. Real estate tax typically refers to the tax on land and any structures on it, whereas property tax can include personal property.

Another common myth is that all properties are taxed at the same rate. Tax rates vary widely based on location and local regulations. This means two similar homes could have drastically different tax bills depending on where they’re situated.

Some people think paying off their mortgage frees them from property taxes. Unfortunately, this isn’t true; homeowners remain responsible for these taxes regardless of their mortgage status.

Conclusion: The Importance of Understanding House Taxes for Homeowners

Understanding house taxes is essential for every homeowner. Real estate and property taxes can significantly affect your financial situation, yet many people overlook their implications.

By grasping the nuances between real estate and property taxes, you empower yourself to make informed decisions. Understanding how these taxes are calculated helps you budget more effectively. This awareness can also guide you when considering ways to reduce your tax burden.

Many homeowners harbor misconceptions about these taxes that could lead to costly mistakes. Educating yourself on common myths allows you to navigate this complex landscape more confidently.

You may also read (are real estate taxes and property taxes the same for your house).