When purchasing a home, one of the most critical steps is conducting a thorough property survey. Buying a house is often the largest financial commitment many of us will make, and it’s no secret that hidden problems can lead to costly repairs later. In fact, studies show that 85% of homebuyers regret skipping surveys, with many facing unexpected defects averaging £10,000 in repairs.

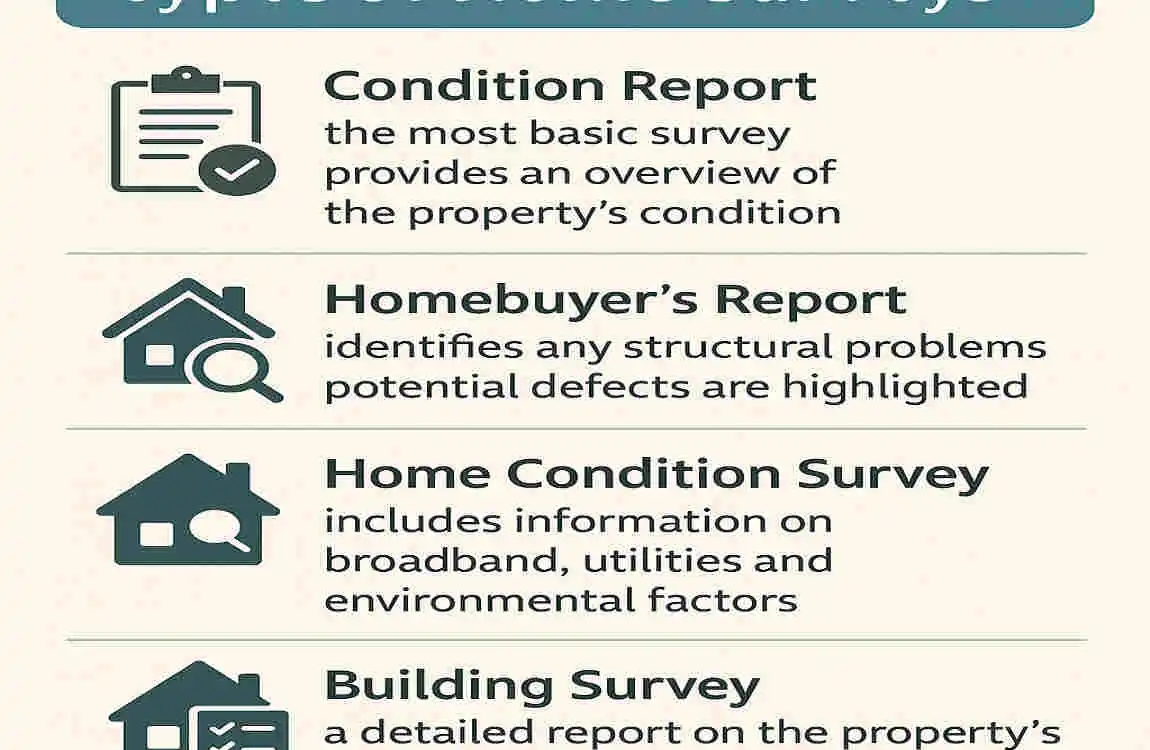

Types of Home Surveys

Choosing the right home survey depends on the property’s age, condition, and your budget. Let’s break down the three main types of surveys offered by the Royal Institution of Chartered Surveyors (RICS). Each level provides varying depths of inspection, catering to specific buyer needs.

Survey Level: What It Covers, Best For, Cost (UK Avg.)

Level 1: Condition Report Basic visual check of accessible areas, no advice. New-builds in good condition. £250-£400

Level 2: HomeBuyer Report Detailed visual inspection, valuation, and risks. Modern/conventional homes (<50 yrs). £400-£600

Level 3: Building Survey Comprehensive checks, repair advice, and deep analyses. Older or listed properties. £600-£1,500

Condition Report

This is the most basic and affordable survey, focusing on the property’s general condition. It highlights major defects but doesn’t provide detailed advice or solutions. It’s suited to new builds or homes in excellent condition.

Home Buyer Report

The Home Buyer Report (Level 2) is the most popular choice for buyers. It offers a detailed visual inspection, includes a valuation, and highlights potential risks such as damp, structural movement, or outdated electrics. It’s ideal for properties under 50 years old.

Surveys:

- Affordable and widely available.

- Covers essential aspects like plumbing, electrics, and damp.

Surveys:

- Does not include invasive checks (e.g., lifting floorboards or removing wall coverings).

Building Survey

For older, larger, or listed properties, the Level 3 survey is your best bet. It’s the most comprehensive inspection, including invasive checks, detailed repair advice, and estimates for future maintenance.

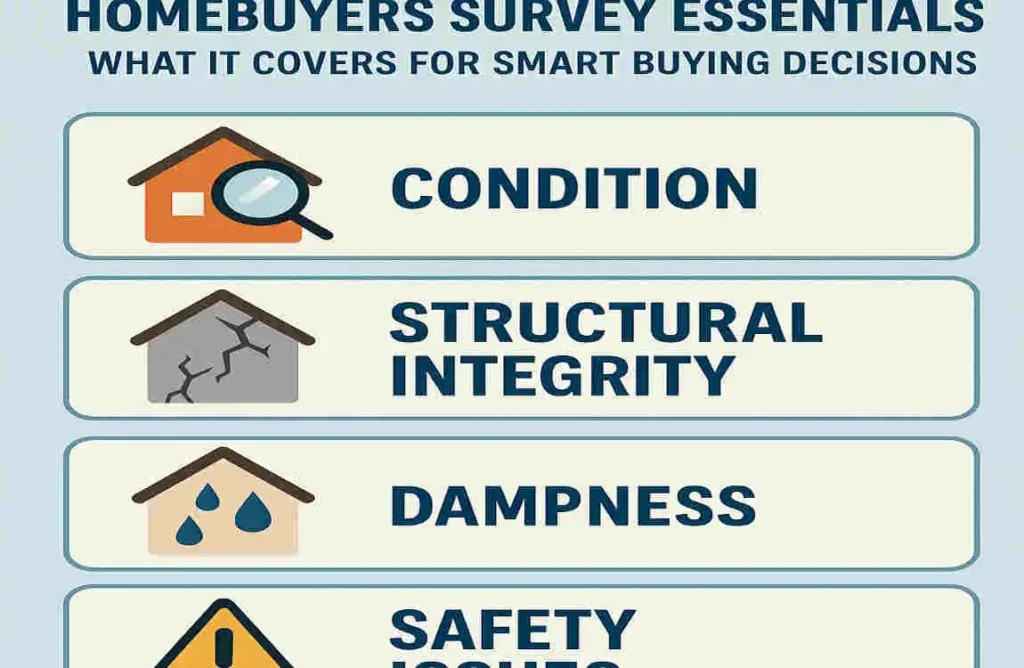

What a Home Buyers Survey Covers: Full Checklist

Now, let’s dive into the core question: What does a home buyer’s survey cover? A typical survey inspects various aspects of the property, both inside and out, ensuring you’re aware of any issues before proceeding with the purchase. Below is a detailed checklist based on RICS standards.

Exterior Inspection

The surveyor will examine the exterior of the property to identify potential structural and maintenance issues. This includes:

- Roof: Checking for damaged tiles, leaks, chimney condition, and flashings.

- Walls: Looking for cracks, signs of subsidence, or damp-proofing defects.

- Windows and Doors: Inspecting for rotting frames, broken seals, and overall condition.

- Gutters and Drainage: Ensuring proper water flow and no blockages.

Interior Inspection

Inside the property, the surveyor evaluates visible areas for defects or hazards:

- Ceilings, Walls, and Floors: Checking for cracks, signs of movement, or timber decay.

- Bathrooms and Kitchens: Assessing plumbing, ventilation, and fixture quality.

- Living Areas and Bedrooms: Identifying layout concerns or issues with electrical outlets.

Services & Systems

The functionality and safety of key systems are also assessed:

- Electrical Systems: Age of wiring, safety of fuse boxes, and overall condition of installations.

- Plumbing and Heating: Boiler efficiency, water pressure, and the quality of pipework.

- Insulation and Damp Testing: Energy efficiency and damp penetration checks.

Outbuildings & Grounds

Surveys also extend to any additional structures or land boundaries:

- Outbuildings (e.g., garages, sheds): Structural integrity and foundation condition.

- Boundaries: Fences, walls, and shared responsibility issues.

Condition Ratings

Surveyors use a traffic light system to rate issues:

- Green (1): No repair needed.

- Amber (2): Minor repairs required.

- Red (3): Urgent repairs or investigations needed.

Common Issues Found & Red Flags

It’s not unusual for surveys to uncover problems. Some are minor, but others can significantly impact your buying decision. Here are the most common red flags and what they mean for buyers.

Damp and Moisture

One of the most frequently reported issues, damp can lead to serious structural problems and costly repairs. Damp-proofing treatments can cost between £2,000 and £5,000.

Roof Defects

Missing tiles, chimney cracks, or sagging roofs are common findings. Repairs can vary but may cost around £3,000- £10,000, depending on the extent.

Structural Movement

Signs of subsidence, such as cracks in walls or uneven floors, are serious concerns. Fixing subsidence can cost upwards of £10,000.

Outdated Electrics

Electrical systems older than 30 years often need rewiring to meet modern safety standards. This can cost £3,000-£8,000.

Infestation or Rot

Woodworm or dry rot affecting timber structures can weaken the property and lead to expensive repairs.

Real-Life Example

One buyer discovered drainage faults during their survey, leading to a £15,000 price reduction after negotiating with the seller.

Benefits of a Home Buyer’s Survey

Why is a home buyer’s survey worth the cost? Here are the key benefits:

Avoid Surprises

A survey identifies 80% of major issues before purchase, saving you from unexpected expenses.

Negotiation Power

Use the survey findings to negotiate a lower price. On average, buyers achieve a 5-10% reduction if issues are discovered.

Long-Term Planning

Surveys help you plan future maintenance and prioritise repairs, ensuring the property remains in good condition.

Energy Efficiency Insights

Modern surveys often include energy efficiency assessments, helping you save on utility bills.

Benefit Impact

Cost Savings £5,000-£20,000 via negotiation/repairs

Resale Value : Fixing issues early boosts resale value

Insurance Accurate rebuild valuation

How to Choose & Arrange a Survey

Follow these steps to ensure you choose the right survey and professional:

- Assess Property Type: Older or listed properties may require a Level 3 survey.

- Request Quotes: Contact at least three RICS-accredited surveyors for pricing.

- Review Documents: Check property deeds, warranties, and previous surveys.

- Timing: Arrange the survey after your offer is accepted.

- Budget: Adjust your budget based on property size and location.

Checklist for Choosing a Surveyor

- RICS accreditation.

- Transparent pricing and detailed reports.

- Specialisation in your property type.